Key Factors

BigBear.ai (NYSE: BBAI) inventory had a tough time following earnings. The inventory plummeted practically 20% following earnings and hasn’t rebounded since then. Given how widespread a man-made intelligence (AI) inventory BigBear.ai was turning into, many buyers are contemplating shopping for the dip.

Whereas this will appear to be a wise concept, buyers want to research the quarter and see if there was a strong cause for the inventory to be down. If that’s the case, then it could possibly be one to keep away from, particularly with so many different robust AI inventory picks obtainable.

The place to take a position $1,000 proper now? Our analyst workforce simply revealed what they imagine are the 10 greatest shares to purchase proper now. Proceed »

Picture supply: Getty Photos.

BigBear.ai is not rising income

BigBear.ai is concentrated on offering AI-powered options, primarily to the federal government, though it has different endeavors (like partnering with the United Arab Emirates) as effectively. In the event you take a look at Palantir, one other government-focused AI firm, you may see its income is rising quick from each industrial and authorities shoppers, with industrial income rising 47% 12 months over 12 months and authorities income rising even sooner at 49%.

BigBear.ai will not be seeing the identical success. In Q1, income fell 18% 12 months over 12 months to $32.5 million. With the large demand for AI merchandise and several other firms quickly rising their income, that is an apparent crimson flag.

Maybe even larger information is that there was a disruption in its U.S. Military contract, which accounts for a big chunk of its income. This precipitated administration to lower its full-year income outlook, elevating one other crimson flag.

BigBear.ai will not be wanting like a real winner within the AI house proper now, and the struggles it is experiencing make it pretty apparent that rivals are offering significantly better merchandise. It is not too late for BigBear.ai to show it round, however there are different points buyers ought to pay attention to.

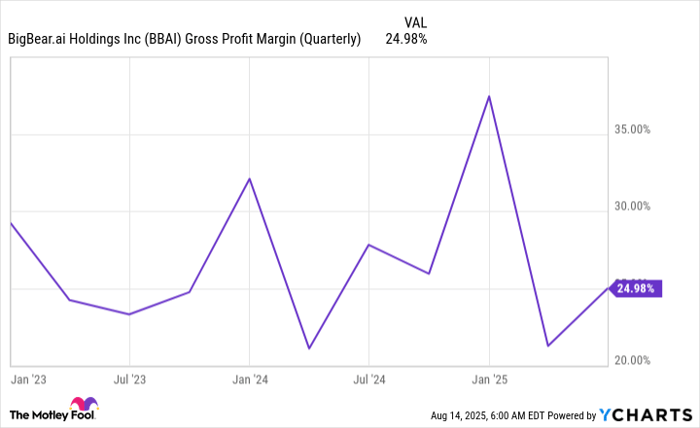

BigBear.ai’s margins are low in comparison with its friends’

Most software program firms produce gross margins within the 70% to 80% vary, with the very best even attending to 90%. Nonetheless, regardless of being a software program firm, BigBear.ai is nowhere close to that degree.

BBAI Gross Revenue Margin (Quarterly) knowledge by YCharts

The corporate has low gross income as a result of BigBear.ai is not providing a standardized software program; it is tailoring every product it delivers to its prospects. That is fairly costly, and limits the potential web revenue it may generate sometime if it turns worthwhile.

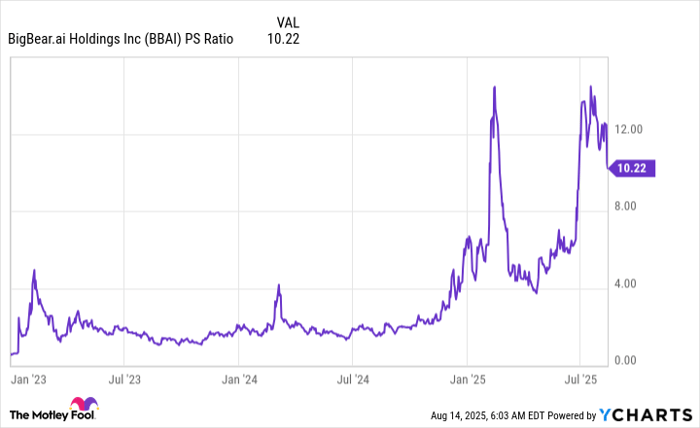

Moreover, resulting from its low gross margin, the rule of thumb that almost all software program firms commerce between 10 and 20 occasions gross sales is ineffective. That rule of thumb assumes that larger gross margins will result in larger revenue margins, thus the elevated valuation ranges. At 10 occasions gross sales, BigBear.ai might be thought-about a very costly inventory, even after the autumn following earnings.

BBAI PS Ratio knowledge by YCharts

BigBear.ai is not a inventory I would suggest anybody put money into. It has falling income at a time when enterprise is unlikely to enhance, and it is seeing issues with its main contract. The corporate’s margin construction is poor, and the inventory is already costly. The bull case for BigBear.ai’s inventory is actually that AI is a rising tide that may elevate all ships. Nonetheless, that is not taking place with BigBear.ai, and there are far too many spectacular AI firms to put money into proper now for anybody to waste time with an underperformer.

Do you have to make investments $1,000 in BigBear.ai proper now?

Before you purchase inventory in BigBear.ai, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and BigBear.ai wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Netflix made this record on December 17, 2004… in the event you invested $1,000 on the time of our suggestion, you’d have $668,155!* Or when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $1,106,071!*

Now, it’s value noting Inventory Advisor’s whole common return is 1,070% — a market-crushing outperformance in comparison with 184% for the S&P 500. Don’t miss out on the most recent prime 10 record, obtainable once you be part of Inventory Advisor.

*Inventory Advisor returns as of August 13, 2025

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

#Purchase #Dip #BigBearais #Inventory

Leave a Reply