Bitcoin slipped 0.11% prior to now 24 hours to $116,702, based on CoinDesk Information, however stays up 25% 12 months thus far, second solely to gold’s 29% acquire amongst main asset lessons, based on information shared by monetary strategist Charlie Bilello on X.

2025 Efficiency to date

As of Aug. 8, bitcoin’s 25% year-to-date return ranked behind solely gold’s 29.3% advance. Different main asset lessons have posted extra modest beneficial properties, with rising market shares (VWO) up 15.6%, the Nasdaq 100 (QQQ) up 12.7% and U.S. giant caps (SPY) rising 9.4%. In the meantime, U.S. mid caps (MDY) and small caps (IWM) 0.2% have solely gained 0.8%, respectively. This marks the primary time gold and bitcoin have occupied the highest two positions in Bilello’s annual asset class rankings since data started.

2011–2025 Cumulative returns

Over the long run, bitcoin has delivered a rare 38,897,420% whole return since 2011 — a determine that dwarfs all different asset lessons within the dataset. Gold’s 126% cumulative return over the identical interval places it in the course of the pack, trailing fairness benchmarks just like the Nasdaq 100 (1101%) and U.S. giant caps (559%), in addition to mid caps (316%), small caps (244%) and rising market shares (57%). Primarily based on Bilello’s figures, bitcoin’s whole return has exceeded gold’s by greater than 308,000 instances over the previous 14 years.

2011–2025 Annualized returns

When measured on an annualized foundation, bitcoin’s dominance is equally clear. The flagship cryptocurrency has delivered a 141.7% common annual acquire since 2011, in contrast with 5.7% for gold, 18.6% for the Nasdaq 100, 13.8% for U.S. giant caps and 4.4% to 16.4% for different main fairness and actual property indexes. Gold’s long-term stability has made it a precious hedge in sure market cycles, however its tempo of appreciation has been far slower than bitcoin’s exponential climb.

Gold vs. bitcoin, based on Peter Brandt

Famend dealer Peter Brandt weighed in on Aug. 8, contrasting gold’s deserves as a retailer of worth with bitcoin’s potential to surpass all fiat options. “Some think gold is a great store of value — and it is. But the ultimate store of value will prove to be bitcoin,” he mentioned on X, sharing a long-term chart of the U.S. greenback’s buying energy. His feedback echo the rising narrative that bitcoin’s shortage and decentralization make it uniquely positioned to outperform conventional hedges over time.

Technical Evaluation Highlights

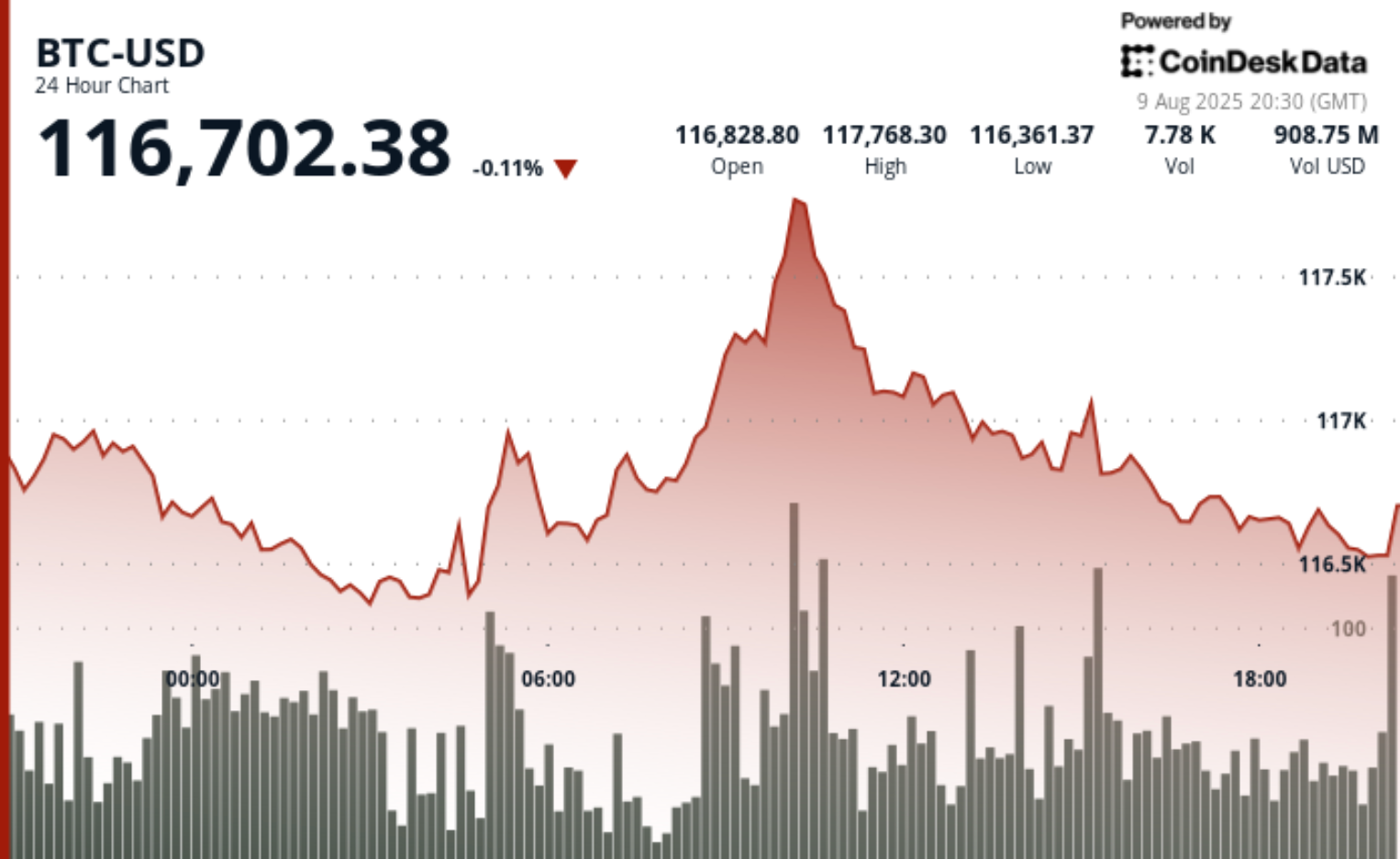

- In line with CoinDesk Analysis’s technical evaluation information mannequin, between Aug. 8 at 21:00 UTC and Aug. 9 at 20:00 UTC, bitcoin traded inside a $1,534.42 vary (1.31%) from $116,352.52 to $117,886.44.

- Worth opened close to $116,900 and moved sideways earlier than surging throughout Asian hours, climbing from $116,440 to $117,886 between 05:00 UTC and 10:00 UTC on Aug. 9, with 24-hour buying and selling quantity exceeding 9,000 BTC throughout these intervals.

- Robust shopping for emerged close to $116,420 at 05:00 UTC, whereas promoting stress intensified across the $117,886 excessive.

- Bitcoin closed the session at $116,517, down 0.32% from the open, with outlined assist at $116,400–$116,500 and resistance at $117,400–$117,900

- Within the last hour of the evaluation interval (Aug. 9, 19:06–20:05 UTC), bitcoin remained below downward stress inside a $195.11 band, sliding from $116,629.40 to $116,519.29 (-0.09%).

- The most important final-hour quantity spike occurred at 19:27 UTC, when 296.43 BTC modified palms as value examined $116,547 assist.

- Restoration makes an attempt have been repeatedly capped close to $116,600–$116,713, according to earlier intraday resistance.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.

#BTC #YTD #Efficiency #2nd #Gold #308709x #Increased #Complete #Return

Leave a Reply