Fairly by accident, it appears like we timed our final speak in regards to the inventory market fairly darned nicely. Again in February 2025, the market put the proper cap on a multi 12 months climb earlier than stepping onto the wild curler coaster we’re at the moment using. Since then it has seen among the steepest drops and recoveries in historical past, shedding a full 20% of its worth on the backside whereas someway managing to finish up proper again close to the height as I’m scripting this.

And though inventory market volatility doesn’t all the time include an simply labeled rationalization, this time the explanation appears fairly clear: it’s the Tariffs.

As our monetary world has been whipped round like a circus tent in a hurricane for the final a number of months, virtually everybody who has a stake on this nation has been questioning what to make of it.

- Can our president actually unilaterally impose 145% tariffs on virtually every thing from our largest provider?

- And in that case, is it actually going to occur?

- And in that case, what’s the level? Aren’t free commerce and low costs a good factor?

- And maybe most significantly, what would the long-term results on our financial system and inventory market be underneath various ranges of tariffs?

As I write this, we nonetheless don’t know the result of the worldwide tariff and commerce battle that our unpredictable authorities has unleashed upon the world. However we’re already seeing the outcomes: companies are bracing for enormous modifications, currencies and rates of interest are reacting, and common buyers such as you and me are questioning what the longer term holds for our early retirement funds. Surveying my very own group of mates, the reactions span the entire vary of feelings from “this is a giant Nothingburger” to “we’re all totally screwed.”

So what’s the true reply? To get nearer to that, we must always begin with probably the most primary query of:

What’s a Tariff?

A tariff is only a gross sales tax charged by our authorities on items that are imported into the nation. They’re paid by whoever is doing the importing – that means you should you order one thing like an e-bike immediately from an organization in China, or by corporations like Amazon, Walmart, or Apple which import merchandise from different international locations by the shipload.

However ultimately, the tariffs aren’t paid by China or Amazon or Apple. They’re paid by you, the tip client, as a result of if their value of products will increase, a retailer is after all going to boost their costs to proceed to make a revenue.

Tariffs additionally have an effect on corporations immediately: if Residence Depot desires to construct a brand new retailer or Chevron wants a brand new oil rig, the tariffs on imported metal, copper, lumber and one million different elements will increase the price of these development tasks. They usually increase the price of housing, as a result of a lot of the constructing supplies in homes come from a number of international locations as nicely.

On common, tariffs will end in greater costs for every thing identical to every other broad-based gross sales tax. And identical to most different taxes, the general impact is to sluggish the financial system and cut back our spending energy. On the optimistic facet, all that tax cash flows into the federal government’s pocket which may assist fund the nationwide finances and even cut back the deficit.

After all, each authorities wants not less than some tax income to perform, so it is smart to make use of some mixture of gross sales, earnings and company taxes to get there. Crucial half is that the degrees should be as little as potential whereas nonetheless holding the nation working nicely, and as honest and predictable as potential, so that folks and companies have an incentive to work exhausting and the flexibility to plan far into the longer term.

And that’s the place our present tariff regime will get it utterly backwards. Donald Trump is throwing round random, extraordinarily excessive tariff numbers as threats, then strolling them again and altering them on an virtually day by day foundation..

Whoa, that Sounds Principally Unhealthy – Is There a Good Aspect of Tariffs?

Generally, a rustic will use tariffs to guard their very own home industries. For instance, should you put a tax on imported Hondas, then Normal Motors vehicles will acquire a aggressive benefit – so GM will make more cash. On this instance, most shoppers find yourself shedding on account of elevated costs and decreased choice. However not less than home auto producers and their staff are blissful.

This may be strategic (for instance we’d wish to slap a tax on imported fighter jets to verify Boeing and Lockheed can stay in enterprise, for nationwide protection functions.) Or it may be corrupt (a politician may obtain funding from kingpins within the metal business, and in return then push by way of tariffs on imported metal to guard the income of US steelmakers.)

And this isn’t only a Trump or Republican factor both – Joe Biden used tariffs throughout his phrases in an try and please swing-state voters. One of many worst examples was a tax on imported photo voltaic panel elements (which Trump has since raised even additional, proving that Boneheadedness will be Bipartisan). These are sheets of low cost glass that actually pump the most cost effective power and best wealth into your nation for 30 years as quickly as you plug them in. Low cost power lowers everybody’s value of residing whereas additionally boosting business. There isn’t any good motive to dam such wealth from flowing throughout your borders.

Can Tariffs Carry Us Extra Jobs?

Let’s return to that hypothetical tax on Hondas, and let’s say it’s a giant one like $5000. At that degree, many patrons will begin heading over to the GM vendor subsequent door to contemplate what he’s promoting. Positive, the GM vehicles will not be nearly as good, however for 5 grand some persons are going to settle as a way to avoid wasting cash.

Due to this, GM’s gross sales go up. In order that they rent extra staff and construct extra factories. They could even develop some new fashions and new applied sciences in response to all that new demand. Extra folks study superior expertise and in one of the best case it turns into a virtuous circle.

However in trade for this increase within the auto business, everybody else has to pay extra for barely shittier vehicles and vans. Increased automobile costs means Amazon should spend extra on their supply fleet, so they may increase costs barely on every thing they promote. Someplace a startup firm or a medical breakthrough can be only a bit much less more likely to occur, as a result of they’re working in an surroundings that’s only a bit dearer and a bit much less environment friendly.

On prime of that, with GM liberated from the effort of competing with Honda, it is going to have much less incentive to innovate and streamline itself. So its general trajectory can be slower and fewer environment friendly even when its income are greater.

This huge image impact is why most economists agree that tariffs needs to be used very sparingly. They virtually all the time trigger surprising harm, lower general employment and decelerate an financial system, however typically (like for meals safety or nationwide protection) these prices are price paying.

So Why is Donald Trump Throwing Round Tariffs Like They Are The Greatest Factor Ever?

This has been complicated to virtually everybody. If you happen to take him at his phrase, he seems to have a Bizarro Reverse Universe perception system about economics. Donald has claimed in speeches that the tariffs will someway make us wealthier. He’s specializing in the first-order results like GM hiring extra staff, whereas utterly ignoring the truth that every thing else within the nation will get much less environment friendly in trade.

However when he pronounces bigger tariffs, share costs go down, as a result of everybody who really runs or invests in US corporations is aware of that after all they may make much less cash on common. When tariffs are paused or lowered, share costs return up. But he retains wielding the threats and we travel.

It appears to be apparent to everybody besides Donald himself that Tariffs are only a nationwide gross sales tax moderately than some intelligent sneaky strategic weapon, which ends up in numerous theories that okay, perhaps he is aware of that too however is simply pretending as a way to acquire some affect.

The essential principle goes like this:

- Unfettered energy: usually, a president can’t impose taxes with out the approval of congress. However there’s a loophole to that: a president can unilaterally impose taxes underneath the disguised identify of “tariffs” within the case of an “emergency”. Moreover, one other loophole exists: there’s no strict definition of “emergency” – so should you simply invent a pretend one you can begin imposing tariffs till congress ultimately catches as much as you. Which will not be for years.

- As a Negotiating tactic: though the first sufferer of tariffs is US shoppers and companies, they will additionally hurt our buying and selling companions, as a result of should you impose a excessive sufficient tax on Chinese language items, we’ll purchase so much much less of them. So now you’ve got unfettered energy which you’ll be able to wield in opposition to your foes, as a approach of getting them to do stuff for you.

- As a approach of controlling home corporations: should you can lower off the lifeblood of any firm (their provide chain) with only a fast publish in your Reality Social account, you’re all of a sudden in charge of the entire financial system. No person can oppose you as a result of you’ll be able to put them out of enterprise instantly.

So proper now our total financial system is topic to the whims of a single particular person.. And so long as that is the case, we’re simply the identical as every other dictatorship – one thing our structure was supposed to stop with the entire “three independent branches of government” factor.

However presidents have tried to interrupt out of their constitutional cage and get extra energy many occasions prior to now, and that is simply the most recent instance. The actual check can be if our system ultimately manages to cease this abuse and put itself again in steadiness because it all the time has prior to now. You may already see this battle starting to play out in our courtroom system, in this Economist article:

How Massive are the Tariffs Proper Now?

Even with out the 145% nonsense numbers that had been thrown round a couple of months in the past, they’re nonetheless far greater than they’ve been within the final 75 years or extra. Whereas it will be exhausting to pin down the present numbers in a stationary weblog publish like this one, the important thing factor to recollect is that our present US financial system is constructed round very low tariffs and comparatively free commerce.

Why haven’t I observed Costs Going Up But?

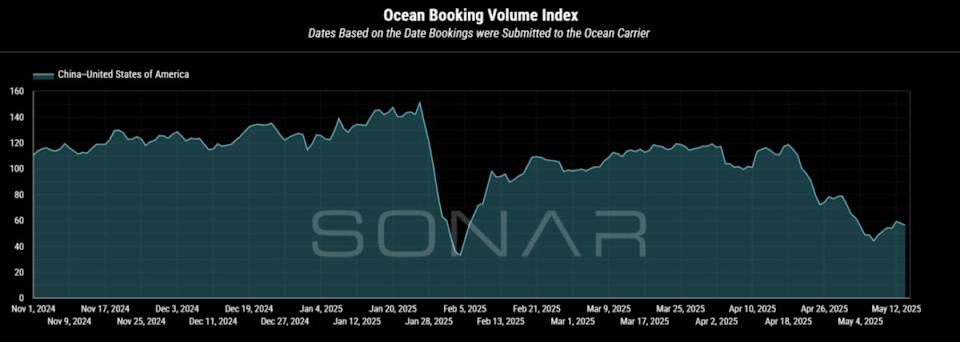

Whereas the US financial system is fueled by a continuing stream of cargo ships, as an entire we perform like the largest cargo ship of all: we now have an enormous stock and it takes some time to alter instructions.

So in regular occasions, we have already got a number of months of stock of most issues within the nation. After which when all this drama began, importers began inserting much more orders to stockpile issues prematurely earlier than the tariffs hit. And now that they’re in place, we’re importing a lot much less stuff.

For now, we’re nonetheless utilizing up the stockpiled stock, however imports have dropped considerably so we’re shortly working out of low cost items. If that occurs, we’ll most likely begin seeing shortages and worth will increase all through this summer time or fall. For some issues like plastic social gathering trinkets, we are able to just do high quality with out. But when we lose entry to core helpful issues like instruments and equipment, the financial penalties can be a lot much less enjoyable.

The Darkish Aspect and the Vibrant Aspect

Crucial phrase to recollect in US politics and economics is the phrase “This too shall pass.” The one thriller proper now could be that we don’t know precisely how it is going to cross. So we may sketch out a couple of situations:

1) The present crazy-high tariffs actually do stick round:

I personally suppose that is the much less seemingly situation as a result of no person actually desires it. However simply as a thought experiment, it would go one thing like this:

- 2025 inflation would greater than double because the tariffs add about 4% to costs

(as a result of imports are roughly 25% of our general spending, and present tariffs are about 16% greater than earlier than. 0.25 * 0.16 = 0.04) - Plenty of corporations will make modifications. These most depending on low cost imports from China may merely exit of enterprise. Some corporations will shift to suppliers in lower-tariff international locations.

- In some instances, US factories will profit. We’ll produce extra metal and sure auto components right here, however you’re not going to see one million factories popping as much as make Nike footwear or microwave ovens – these issues will simply get much more costly to purchase.

- Demand for disagreeable, repetitive low-wage disagreeable manufacturing facility work will improve, which ought to assist increase the entire lower-income wage pool. However the price of residing for these folks may greater than outstrip these wage features. Plus, these jobs will ultimately part again out as producers proceed to construct robots to automate these jobs.

- Different international locations will proceed to retaliate with tariffs on US items, which suggests our exporting corporations will lose income. For only one enjoyable instance, Canada just lately imposed a 100% tariff on Tesla vehicles from the US, virtually utterly destroying that firm’s Canadian gross sales in a single day.

- Authorities tariff income may go up by about $640 billion yearly (about 15 p.c of our complete finances), however the discount of financial exercise and exports would cut back earnings tax income by an unknown quantity – presumably a fair greater quantity.

2) They do find yourself being only a negotiating tactic and we return to principally low tariffs.

- The inventory market would stage an unlimited “relief rally”

- Corporations will step by step begin to calm down and return to the way in which they had been, permitting for extra planning and hiring to renew

- We’ll escape with only a few hundred billion {dollars} of misplaced financial exercise and a reasonably massive hit to our credibility as a nation, which is able to fade over time identical to every thing in politics

- A few of the “deals” that are a part of the negotiations (for instance, decrease tariffs in different international locations) might have advantages for US exporters, serving to enhance our future commerce

In different phrases, one of the simplest ways to win the tariff sport is to not play it.

Simply as a lot of US prosperity is constructed upon our large inhabitants of 330 million folks residing in 50 states with open borders and no commerce restrictions, all (pleasant) international locations of the world can profit from the free trade of products, companies and even folks. We’re all human beings and if we deal with one another with a collaborative respect, all of us develop richer.

Epilogue: Is it Nearly Over Already?

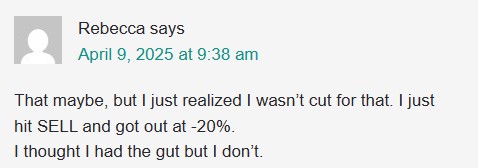

I began writing this text on April 2nd, when Donald introduced his “Liberation Day” and the inventory market reacted with the largest drop since 1932. Some folks panicked and locked in huge losses regardless of a long time of warnings out of your favourite monetary bloggers, like this unlucky soul within the feedback to a JL Collins publish:

–

However as I watched over the following two months, we now have bounced our approach again up – with every drop in proposed tariffs triggering a corresponding improve in inventory costs (a measure of investor enthusiasm of how vibrant our future appears).

Proper now, the US inventory market is nearly again to its all-time excessive. This doesn’t match with our present degree of tariffs, that are nonetheless about seven occasions greater than they had been earlier than the circus opened. However it reveals that buyers imagine it’s all going to finish with a truce and a resumption of free-ish worldwide commerce.

In the event that they’re mistaken, the curler coaster journey will nonetheless have some extra enjoyable in retailer for us. However so long as we ultimately finish our present experiment in “emergency” tariff dictatorship and get again to functioning as a democracy, issues needs to be simply high quality in the long term. I’m nonetheless 100% invested myself, in order that’s the place I place my wager.

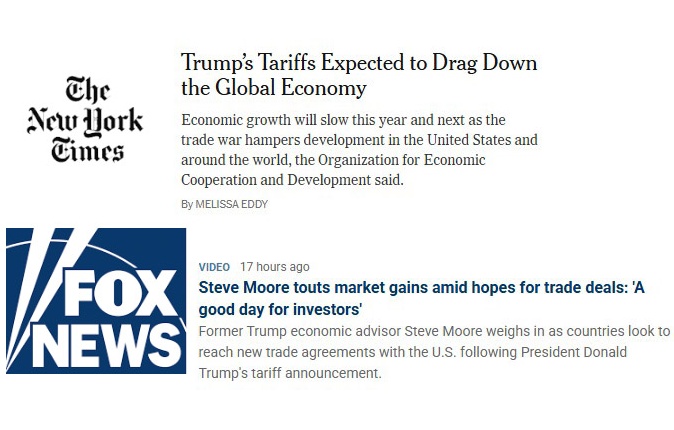

The Largest Lesson: Don’t Type Your Opinions Based mostly on Information Headlines

A long time in the past in a brighter age of journalism, there might have been a time when headlines had been designed primarily to tell us, with only a little bit of sizzle and spice to tug in our consideration. Sadly, these days the priorities have flipped the place the first objective is consideration, and accuracy carries little or no weight. Even a completely inaccurate article makes cash for the writer.

–

So whereas Democrats and Republicans love to do battle over which media sources are biased, in actuality they’re all mistaken: all click-funded industrial media is biased – typically politically however much more importantly biased in the direction of producing outrage and worry, as a result of these generate more cash.

There are two options to this:

1) Both ignore the media utterly and focus by yourself life, or

2) Change into a topic professional on stuff you actually care about, after which learn the unique sources everytime you wish to find out about one thing.

I principally follow possibility #1, however as a science and know-how nerd I get into #2 in simply the areas I discover most attention-grabbing. And it’s wonderful how the extra deeply you perceive a topic, the extra you see simply how mistaken most media tales are about your space of experience. Which implies they’re most likely fairly mistaken about virtually every thing.

In order all the time, with this lesson realized it’s time to close down that cellphone and laptop computer, exhale all our worries and get again exterior along with your real-life household and mates. See you in a couple of months!

Associated:

Why We Are Not Actually All Doomed – the unique all-purpose MMM article which explains why we by no means actually have to fret in regards to the long-term financial future.

#Navigate #Tariff #Circus

Leave a Reply